What follows is a very brief summary of an appendix in my micro textbook that addresses the libertarian case for free markets. It was triggered by the comment of Tyler Cowen that the left needs more Mill.

There are three kinds of freedom, each valid. The first is negative freedom, “freedom from”, which means simply freedom from external coercion. This is what underlies the libertarian attachment to free markets. The second is positive freedom, “freedom to”, which seeks to provide people the means to realize their (feasible) objectives. Traditionally the left has seized on this notion to justify redistributive institutions and policies. The third is “inner freedom”, freedom from habit, custom, and unreflected assumptions, which was the core message of German idealism, English and French Romanticism and American Transcendentalism (and, at its best, rock and roll).

In a perfect world we would bask in all three of them. Unfortunately, each makes demands on the others, and there is no universal criterion for striking a balance. The first step toward a reasonable politics of freedom, however, is to simply recognize that no one conception is sufficient by itself.

Finally, it’s important to recognize that freedom, according to any interpretation, is always limited by obligation. In particular, we have obligations toward children, the very old or disabled and others who depend on us for the necessities of life. One way collective action can widen the domain of freedom is by helping us to meet these responsibilities more efficiently. Consider, for instance, how public education and pension systems (like Social Security) widen the scope for parents and children of their elderly parents to be freer in other aspects of their lives.

Saturday, January 30, 2016

Friday, January 29, 2016

A Theory Explaining Why Severe Weather is Occurring

Piecing the current theory together:

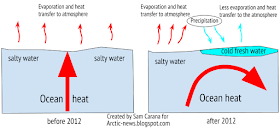

Global warming is slowing the gulf stream system, also known as the Atlantic Meridional Overturning Circulation (AMOC). The AMOC is a gigantic ocean system that’s driven by differences in temperature and the salinity of sea water. Ocean temperatures off the U.S. east coast are warming faster than global average temperatures and there’s a “cold blob” in the subpolar Atlantic understood to be sourced from Greenland ice-melt water. These latter two features are regarded (by some scientists) as a characteristic response to a warmer world. The slowdown of the AMOC is in turn, a result of the ocean freshening at high latitudes due to these large infusions of meltwater from Greenland resulting in a cooling in the North Atlantic region, as less ocean heat reaches the region — aka, the “blob.”. The far North Atlantic waters are being diluted by the Greenland melt waters and are no longer salty enough. Therefore the waters don’t sink as much, and this slows (or may even eventually shut down the AMOC circulation. The AMOC global conveyor has been weakening, by the way, since the late 1930s. The slowing of the Gulf Steam System/AMOC should drive faster sea level rise on the East Coast where sea level rise for a 600-mile-long “hotspot” along the East Coast (north of Cape Hatteras) has already been measured at “3-4 times higher than global average”. A 2015 discussion paper by some of the world’s leading climatologists argues that “Shutdown or substantial slowdown of the AMOC, besides possibly contributing to extreme end-Eemian (brief? sea level) events, will cause a more general increase of severe weather.”

REFERENCES:

(i) The surprising way that climate change could worsen East Coast blizzards

By Chris Mooney January 25, 2016

https://www.washingtonpost.com/news/energy-environment/wp/2016/01/25/climate-scientist-why-a-changing-ocean-circulation-could-worsen-east-coast-blizzards/?postshare=1471453766419405&tid=ss_tw

(ii) Recent studies from the National Oceanic and Atmospheric Administration found that ocean temperatures off the U.S. East Coast are expected to warm three times faster than the global average. The warming coincides with increased C02 emissions.

(iii) Stefan Rahmstorf of the Potsdam Institute for Climate Impact Research, an expert on the Atlantic circulation phenomenon known by the technical name meridional overturning circulation, or AMOC.

(iv) The Greenland melt. Eric Steig. 23 January 2013.

http://www.realclimate.org/index.php/archives/2013/01/the-greenland-melt/

(v) Is Climate Change Supercharging Storms Like Jonas And Sandy More Than We Thought? by Joe Romm Jan 25, 2016 4:41 pm

http://thinkprogress.org/climate/2016/01/25/3742321/climate-change-jonas-sandy/

(vi) Blizzard Jonas and the slowdown of the Gulf Stream System.

Stefan. 24 January 2016

http://www.realclimate.org/index.php/archives/2016/01/blizzard-jonas-and-the-slowdown-of-the-gulf-stream-system/

Wednesday, January 27, 2016

Why GDP fails as a measure... period

At CBS Moneywatch, Mark Thoma reviews the standard "textbook" flaws in GDP that cause it to fail as a measure of wellbeing:

- It counts "bads" as well as "goods."

- It makes no adjustment for leisure time.

- It only counts goods that pass through official, organized markets,

- It doesn't adjust for the distribution of goods.

- It isn't adjusted for pollution costs.

Thoma then points to the discussion in Davos of another flaw in GDP -- it doesn't fully account for the benefits of technology. Isn't that just part of only counting goods that pass through official markets? GDP also doesn't adjust for the unpaid work outsourced to consumers. Some of the "benefits" of technology are a matter of perspective as well as taste.

Although useful as a framing introduction, Thoma's discussion misses three crucial points. First, GDP was never meant to be a measure of wellbeing but a measure of the revenue-generating capability of the economy. In this capacity, a more salient flaw is the arbitrary treatment of government expenditures as output for final consumption when much government spending would be better treated as intermediate goods to avoid double counting.

Another flaw results from the instability of the unit in which GDP is measured and reported. Change in GDP from period to period doesn't simply represent a proportional increase or decrease of the same goods and services at the same prices but a changing mix of goods and services at different prices. Adjusting for "real GDP" with an average index for inflation may provide a short term, rough estimate of the vitality of economic activity but cumulative changes in the GDPs composition renders long-term assessments of "growth" essentially meaningless.

The third point is actually a combination of that last flaw and Thoma's first point that GDP counts "bads" as well as goods. But first a clarification of Thoma's explanation. -- GDP doesn't count the earthquake; it counts the repairs and rebuilding. Thus the problem is that the accounting is asymmetrical -- adding the repairs without subtracting the damage that required the repair. Over time, the proportion of total economic activity devoted to remedial goods and services increases, resulting in what Stefano Bartolini refers to as "negative externality growth." The cumulative effect is thus not just additive but multiplicative in that the increasing proportion of remedial goods and services distorts the index by which the prices for welfare-enhancing goods and services are adjusted.

A rubber band yardstick would be unreliable. This one is silly putty.

What it all adds up to is the arbitrariness of the idea of an objective aggregate measure of economic activity. Tinkering with some minor technical detail is not going to result in a "more accurate" measure -- simply a different measure whose accuracy or otherwise will be a matter of subjective judgment.

The questions we need to ask are: What do we really want to know and why? What purposes were we pursuing when we sought to measure economic activity? Is measuring GDP helping to achieve those purposes? Are those purposes still our priorities? If not, what should be? What different institutions might we invent to achieve our purposes as we NOW understand them?

Tuesday, January 26, 2016

Is Global Warming Behind The Record Snowfall Of Winter Storm Jonas?

Maybe.

Two days ago on RealClimate a post entitled "Blizzard Jonas and the Slowdown of the Gulf Stream System" suggests that there might be a link. The argument is that rising ocean surface temperatures in the North Atlantic, especially somewhat south of Greenland, are tied to a slowing of the Gulf Stream. These higher temperatures off the US East Coast then may be a clause of larger snowfalls in storms in the eaastern US, with a possible direct influence on this coming from warmer fresh water coming off Greenland with glacier melt. If this continues there could also be substantial impacts on northwestern Europe, although these may include cooling in some places. This is tentative, but certainly something that should taken seriously and further studied.

Let me compare this with a possibly related phenomenon, which provides a warning that we must proceed cautiously with this. I am referring to the widespread reports about a decade ago claiming that global warming was increasing the frequency of hurricane in North America. Quite a few public figures made a great big fuss over this, including Al Gore. However, it turns out that the effect is a very complicated mixed bag, and if anything it is the other way around, warming temperatures may lead to a lower frrequency of Atlantic hurricanes? How can this be? One possibility is higher temperatures bring more sandstorms in western Africa that blow over the Atlantic, with this greater sand in the air inhibiting the formation of tropical depressions that lead to hurricanes.

While that may be the case, there is stronger evidence, although this remains a matter of serious debate among climatologists, about the intensity of hurricanes that do occur, and such storms as Katrina and Sandy (which hit the New Jersey shoreline with flooding as Winter Storm Jonas has) being poster children for this. The argument on this is really straightforward: intensity of hurricanes does seem to be tied to higher late summer sea surface temperatures in the Atlantic and the Gulf of Mexico. So, the case for more intense hurricanes to occur even as there may be fewer hurricanes overall is serious, if not universally accepted by climatologists, and the mechanism would have similarities to the phenomenon now being posed as possibly increasing snowfall amounts in the eastern US due to warmer ocean surface temperatures in the Atlantic.

Barkley Rosser

Two days ago on RealClimate a post entitled "Blizzard Jonas and the Slowdown of the Gulf Stream System" suggests that there might be a link. The argument is that rising ocean surface temperatures in the North Atlantic, especially somewhat south of Greenland, are tied to a slowing of the Gulf Stream. These higher temperatures off the US East Coast then may be a clause of larger snowfalls in storms in the eaastern US, with a possible direct influence on this coming from warmer fresh water coming off Greenland with glacier melt. If this continues there could also be substantial impacts on northwestern Europe, although these may include cooling in some places. This is tentative, but certainly something that should taken seriously and further studied.

Let me compare this with a possibly related phenomenon, which provides a warning that we must proceed cautiously with this. I am referring to the widespread reports about a decade ago claiming that global warming was increasing the frequency of hurricane in North America. Quite a few public figures made a great big fuss over this, including Al Gore. However, it turns out that the effect is a very complicated mixed bag, and if anything it is the other way around, warming temperatures may lead to a lower frrequency of Atlantic hurricanes? How can this be? One possibility is higher temperatures bring more sandstorms in western Africa that blow over the Atlantic, with this greater sand in the air inhibiting the formation of tropical depressions that lead to hurricanes.

While that may be the case, there is stronger evidence, although this remains a matter of serious debate among climatologists, about the intensity of hurricanes that do occur, and such storms as Katrina and Sandy (which hit the New Jersey shoreline with flooding as Winter Storm Jonas has) being poster children for this. The argument on this is really straightforward: intensity of hurricanes does seem to be tied to higher late summer sea surface temperatures in the Atlantic and the Gulf of Mexico. So, the case for more intense hurricanes to occur even as there may be fewer hurricanes overall is serious, if not universally accepted by climatologists, and the mechanism would have similarities to the phenomenon now being posed as possibly increasing snowfall amounts in the eastern US due to warmer ocean surface temperatures in the Atlantic.

Barkley Rosser

Who Needs Hatchet Jobs?

The Sandwichman was flattered to have been the subject of a two-and-a-half-page rebuttal by self-styled "anarcho-capitalist" economist Pierre Lemieux in his 2014 book Who Needs Jobs: Spreading Poverty or Increasing Welfare. Lemieux devotes an entire chapter to "The Lump of Labor Fallacy."

Lemieux gets two things right in his rebuttal. He affirms that the lump of labor fallacy is the inverse of "Say's Law" that "supply creates its own demand." Some people would argue that the so-called Law is not a law and that it is not Say's. Anyway, the logic is if you don't believe "supply creates its own demand" then you are assuming that the amount of work to be done is fixed. It's a bizarre claim and I'm glad someone

Other than portraying me as "a proponent of compulsory reduced working time", his initial summary of my argument in the first two paragraphs is fair enough except for a peculiar claim about S.J. Chapman ending his career as a "controller of matches" during World War II. Chapman retired before the start of World War II and suffered from a stroke in the early 1940s. There actually is a brief entry on Chapman in a 1991 book, The Professionalization of Economics, that ends with "Controller of Matches, 1939-44" but gives no explanation of what this title could possibly refer to.

Other than that the chapter is a superficial hatchet job, if I do say so myself. I am hoping that someone would be interested in doing a rebuttal to Lemieux's rebuttal. I have a dropbox full of pdfs for anyone who wants to pursue that. Here is a picture of Lemieux with Conrad Black in 2005:

Here is the excerpt from Lemieux's book in which he tries to refute the Sandwichman's critique of the lump-of-labor fallacy claim.

One recent proponent of compulsory reduced working time is activist Tom Walker. Although he claims that the lump-of-labor theory is not necessary for defending his proposal, he is obviously sympathetic to it and invokes economists who supposedly did not consider it a fallacy. Walker’s basic argument is that better-rested workers would become more efficient (have a higher productivity), push product prices down, and thus increase consumer demand for them.

This argument rests on the double assumption that labor productivity can be increased by reducing working time, and that the employers don’t realize it and have to be forced to follow their own interest. Why would greedy capitalists fail to see something so obviously profitable that an armchair writer can discover it? Because, Walker argues, competition prevents employers from acting on their discovery even if they do find out that shorter hours are productivity enhancing. In this line of argument, Walker follows a 1909 article by economist Sydney Chapman, a British civil servant who, during World War II, ended his career as controller of matches for His Majesty’s government. The Chapman-Walker argument goes as follows. Suppose some firms realize the productivity potential of shorter hours and reduce the working time of their employees without cutting pay. Competing firm would “poach” the well-rested employees by offering them higher pay for more work. Thus, competition would lead all firms to end up overworking their employees again.

This explanation is very weak. How could a poaching firm offer a pay raise to a worker who, by hypothesis, would become less productive when he worked more? And if the poaching firm did not offer a pay raise to the poached worker, why would he leave a firm where he works fewer hours to move to one which would overwork him for the same price? Such inconsistent behavior assumes that individuals are unable to choose the optimal number of work hours necessary to maximize their utility. Individuals can certainly make mistakes, but generally assuming that individuals cannot choose what is best for them, given their preferences and constraints, is at best paternalistic, at worst elitist. If an individual cannot make an optimal choice for himself between leisure and work, how could bureaucrats and politicians be able to do it for him? How would intellectual dilettantes know what’s best for other individuals—and how can they be so sure of their hunches that they are willing to coercively impose them? Chapman did recognize that intervention is justified “if it be assumed that the State can discover what is best for the country.”

Walker cites John Hicks’s The Theory of Wages in support of his argument, apparently misreading the famous economist. Hicks had raised questions that became Chapman’s and Walker’s arguments, but he had broadly dismissed them. If they make an error about their employees’ productivity, employers will sooner or later realize it. Employees can also make temporary mistakes, but competition is a better way than government intervention to correct the situation. Talking about the individual who “endeavours to protect himself, through Trade Unionism and the democratic State,” Hicks concludes:

"But our examination of the effects of regulation has shown that this protection can rarely be adequate. Carried through the end, it can only result in a great destruction of economic wealth."

Walker falls into Keynes’s trap of general overproduction, and further adds the idea that “demand for any given commodity will inevitably reach a saturation point.” It is not impossible that demand for a certain good will reach saturation. Consumption time being limited to 24 hours a day, and storage space carrying a cost, there is only a certain number of Ferraris that an individual would want. When each American owns three Ferraris, he may not want another one. He would rather consume something else during the time he is not driving or admiring his cars. But it is unlikely that consumption in general will ever reach a saturation point. There is always something else that some individual would like: a farm, a yacht, a plane, a private library, a larger ranch, a longer yacht, a larger plane, a larger private library, another vacation trip, and so forth. And if a given individual does reach general saturation, he may decide to give his money to others. The market response seems to make intervention in working time unnecessary and undesirable.

After all, Walker does have to rely on the lump-of-labor fallacy. He laments that the arguments for reducing working time to combat unemployment “have not been engaged by any of the authors who assert that reduced working time policies are populist nostrums bereft of sound economic reasoning.” The reason why few serious economists have engaged lump-of-labor arguments is, I suggest, that they are indeed bereft of sound economic reasoning.

Just to give you a whiff of Professor Lemieux intellectual standard, let me give a little more context for that concluding "lament" of mine. I was discussing the contributions of John R. Commons, Luigi Pasinetti and John Maynard Keynes -- I could have added Chapman, Maurice Dobbs, A. C. Pigou, John Maurice Clark and several labor economists that were well regarded in their day. So here is the full quote from my article that Lemieux truncated:

What Commons, Keynes and Pasinetti have in common, besides their views that the reduction of working time is one way to combat unemployment, is that their analyses have not been engaged by any of the authors who assert that reduced working time policies are populist nostrums bereft of sound economic reasoning.In the page and half leading up to that lament I had summarized the relevant contributions of Commons, Keynes and Pasinetti. rather than engage those arguments, Lemieux chose to glibly misrepresent my passage by lifting it out of context. I've told this story before but it is appropriate here. Speaking to the motion to censure Senator Joseph McCarthy, Senator Sam Ervin gave this folksy illustration of McCarthy's slippery ways with words:

I now know that the lifting of statements out of context is a typical McCarthy technique. The writer of Ecclesiastes assures us that "there is no new thing under the sun." The McCarthy technique of lifting statements out, of context was practiced by a preacher in North Carolina about 75 years ago. At that lime the women had a habit of wearing their hair in top-knots This preacher deplored the habit. As a consequence, he preached a rip-snorting sermon one Sunday on the text, "Top Knot Come Down." At the conclusion of his sermon an irate woman, wearing a very prominent top-knot, told the preacher that no such text could be found In the Bible. The preacher thereupon opened the Scriptures to the 17th verse of the 24th chapter of Matthew and pointed to the words:

"Let him which is on the housetop not come down to take anything out of this house."

[Laughter]

Any practitioner of the McCarthy (Lemieux) technique of lifting things out of context can readily find the text, "top not come down" in this verse.

Saturday, January 23, 2016

Xenophobia: the One on the Right is on the Left?

An ad for Ted Cruz shows actors in suits running through fields and wading across a river, presumably representing the Rio Grande. The voiceover features the candidate from a November 2015 Republican presidential candidates' debate:

"I can tell you, for millions of Americans at home watching this, it is a very personal economic issue. And, I will say the politics of it will be very, very different if a bunch of lawyers or bankers were crossing the Rio Grande. Or if a bunch of people with journalism degrees were coming over and driving down the wages in the press.

"Then, we would see stories about the economic calamity that is befalling our nation. And, I will say -- for those of us who believe people ought to come to this country legally, and we should enforce the law -- we're tired of being told it's anti-immigrant. It's offensive."Cruz is undoubtedly correct that if the jobs of lawyers, bankers and journalists were disappearing, we would hear much more about it. As to how many jobs of "ordinary Americans" are being stolen by immigrants -- probably not a lot in the larger scheme of things, compared to austerity policies, trade deficits and the fallout from reckless financial speculation.

But how many jobs is beside the point. People have expectations about their future prosperity. They save money to buy homes, to start a business or to retire. They put in overtime hours to try to "get ahead." If after ten, fifteen or twenty years in the work force they are "another day older and deeper in debt," they are prone to feel that something about the system is holding them back.

Maybe they are wrong. Maybe it is their own damn fault. Maybe they're right about the system holding them back but wrong in detail. In some cases, maybe they are right about the near term effects of immigration on their job security.

Economists have soothing words for these anxious people: "don't worry," they assure the common folk, "in the long run everything will be fine. The number of jobs will adjust automatically to accommodate the increase in the work force." This is, of course precisely the attitude Keynes lampooned with his remark about everyone being dead in the long run. Alan Manning, for example, explains in his lecture on the economics of migration:

"The important point is that in the... in the long run, increases in labor force -- and I'll try to explain why in a minute -- cause changes... bring about changes in employment more or less one to one."Supply of labor, that is to "Say," creates its own demand for labor. Say's Law or the purported version of Say's Law, which reputedly sank without trace after Keynes criticized it. It comes as no surprise that people deny it when I point out that the lump-of-labor fallacy claim is the negative projection of Say's Law. But "increases in labor force... bring about changes in employment" is clearly a paraphrase of "supply creates its own demand."

Again, I'm not saying this is either what Say wrote or any kind of a law. "Say's Law" is simply the name attached to that particular idea.

So, the progressive "wonks" -- Oxford educated London School of Economics professors are combatting virulent right-wing xenophobia with... stale truisms that were discredited 80 years ago and sank without trace? ARE YOU KIDDING ME? I mean, am I kidding you? No. It's as if the quack physicians in Moliere's L'Amour Médecin had come back to life to prescribe leeches and emetics as panaceas.

See also my earlier post on Doctor Krugman and Mister Trump.

Flippity, flop -- it's done...

A customer walks into Nick's Bar and Grill and sees a sign advertising the special steak dinner $10. He orders the special and a beer. Ten minutes later, the server brings him a grilled Spam burger on a bun.

"I ordered a steak." the customer complains.

"I'm sorry sir," the server replies, "we're all out of steak but, don't worry, there is not a fixed amount of meat."

"I don't want Spam. I want steak." the customer protests.

The server goes back to the kitchen and calls out the cook to explain, "Yesterday, we served 100 meat meals to 100 customers. Today, we had 150 customers and we served 150 meat meals to them. The amount of meat we serve is not fixed!"

"But I don't like Spam. I ordered steak." the customer insists.

The cook goes upstairs to the office and brings the manager down to explain, "We have monitored the serving sizes and the portions of Spam we served today to customers receiving Spam are exactly the same weight as the portions served yesterday. The portions of steak are even a little big bigger. There is not a fixed amount of meat to go round."

The angry customer stands up and leaves.Repeat this story several hundred times and you get the picture of the relentless farce of the lump-of-labor fallacy refrain. Why can't the customer understand that there is not a fixed amount of meat to be served? Why can't the worker understand that there is not a fixed amount of work to be done? Because, quite simply, that explanation has nothing to do with what the customer of working assumed.

The customer assumed that he would get a steak. The worker assumed that she would get a higher paying job with better prospects for promotion. Whether those expectations were realistic or not, the fact that the customer was served a piece of meat or the worker got a part-time, on-call position at Walmart doesn't mean that their wants were gratified.

This is not some complicated mathematical model that goes on for several pages. The is a simple matter of a stubborn refusal by economists to listen. Your lump-of-labor fallacy is bullshit, economists. The empirical evidence you present to "refute the mistaken assumption" is beside the point. YOU, the economists, are making the fallacious assumption, not the workers who are unhappy that there is not an unlimited supply of GOOD, WELL-PAYING jobs to go round.

The stock economists' prescription for that unhappiness is "more education" or, as the oracles of Davos would recommend:

- rapid adjustment!

- new reality!

- concerted effort!

- innovating!

- front and centre!

- new mindset (to optimize resilience)!

Sandwichman's Lump-of-Labor Odyssey Part III

In Part I of my lump of labor tale, Sandwichman told about how he had first encountered the fallacy claim back in 1997 and then delved way back in history to the earliest inklings of the idea of a fixed amount of work in the mid-17th century and the first known repudiation of that idea toward the end of the 18th century.

In Part II, I riffed off of Larry Summer's newly found scorn for the Luddite fallacy -- one of the several alias for the lump of labor -- talked about an answer to my query I had received from Paul Samuelson in which he was remarkably vague about the origins of the fallacy claim that appeared for half a century in his textbooks and concluded with a transcript of an exchange from 1999 with Brad DeLong.

I haven't yet mentioned publications of my research on the lump and the acknowledgement (or lack of one) that scholarship has received from economists who have continued to invoke the lump of labor fallacy as if there was utterly no question of its authority.

About a week ago, Alan Manning, professor of economics at the London School of Economics gave a talk there on "The Economics of Migration" in which he evoked the so-called lump of labor fallacy as a way of interpreting people's anxieties about the effect of immigration on unemployment.

Most of the presentation is informative and well argued. At about 38 minutes and 50 seconds into his lecture, though, Professor Manning appears eager to persuade his audience of a matter than he thinks is an "important point" -- that the amount of work to be done is not fixed. Who would have thought otherwise? Is water dry? Is up down? But for some reason, Professor Manning expresses doubt that he can convince people of this rather unremarkable fact. Could the problem possibly be that it is difficult to persuade people to stop doing something that they are not actually doing? Maybe he didn't think of that.

I have edited a 3 minute and 44 second segment of Professor Manning's lecture in which he mentions the lump of labor fallacy and virtually begs his audience not to believe that the amount of work is fixed. "It's completely wrong to think/ of the number of jobs as being fixed." At about 2:09 of this excerpt, Manning mentions that "labor economists have a word for the view that the number of jobs is fixed. They call it -- the sort of -- the lump of labor fallacy. And it really is exactly that. The number of jobs in an economy is not fixed." Again at 3:34 he exhorts his audience, "but please do not believe in the lump of labor fallacy that's just one thing I would say." (And while you're at it folks, please, please stop believing in unicorns.)

In Part II, I riffed off of Larry Summer's newly found scorn for the Luddite fallacy -- one of the several alias for the lump of labor -- talked about an answer to my query I had received from Paul Samuelson in which he was remarkably vague about the origins of the fallacy claim that appeared for half a century in his textbooks and concluded with a transcript of an exchange from 1999 with Brad DeLong.

I haven't yet mentioned publications of my research on the lump and the acknowledgement (or lack of one) that scholarship has received from economists who have continued to invoke the lump of labor fallacy as if there was utterly no question of its authority.

About a week ago, Alan Manning, professor of economics at the London School of Economics gave a talk there on "The Economics of Migration" in which he evoked the so-called lump of labor fallacy as a way of interpreting people's anxieties about the effect of immigration on unemployment.

Most of the presentation is informative and well argued. At about 38 minutes and 50 seconds into his lecture, though, Professor Manning appears eager to persuade his audience of a matter than he thinks is an "important point" -- that the amount of work to be done is not fixed. Who would have thought otherwise? Is water dry? Is up down? But for some reason, Professor Manning expresses doubt that he can convince people of this rather unremarkable fact. Could the problem possibly be that it is difficult to persuade people to stop doing something that they are not actually doing? Maybe he didn't think of that.

I have edited a 3 minute and 44 second segment of Professor Manning's lecture in which he mentions the lump of labor fallacy and virtually begs his audience not to believe that the amount of work is fixed. "It's completely wrong to think/ of the number of jobs as being fixed." At about 2:09 of this excerpt, Manning mentions that "labor economists have a word for the view that the number of jobs is fixed. They call it -- the sort of -- the lump of labor fallacy. And it really is exactly that. The number of jobs in an economy is not fixed." Again at 3:34 he exhorts his audience, "but please do not believe in the lump of labor fallacy that's just one thing I would say." (And while you're at it folks, please, please stop believing in unicorns.)

So here is the text of the email I dispatched to Professor Manning:

Dear Professor Manning,

When economists invoke the "lump-of-labour fallacy" I have to wonder how much research they have done on the history of the fallacy claim and how much documentation they have looked at on opinions of people who are alleged to believe there is a fixed number of jobs in the economy. I have done extensive research on these matters and the answer seems to be 0 and 0. This doesn't seem to matter, though, because they are economists repeating what other economists have said repeating what other economists have said, etc., in other words, an appeal to authority ad infinitum ad nauseam.

"Professor Manning expanded on the “lump of labour” fallacy, which assumes that the number of jobs in an economy is fixed, and therefore an influx of labour must take away jobs from some people. He refuted this by showing that countries with big increases in the labour force have proportional increases in the employment rate, and emphasising that the economy is elastic and the number of jobs in an economy is not fixed."

I don't suppose you would be interested in my research on the lump of labour fallacy but in case you would care to challenge you preconceptions rather than indulge them, here are citations of my published articles on the fallacy claim:

2000, "The 'Lump-of-Labor' Case Against Work-Sharing: Populist Fallacy or Marginalist Throwback?" in Working Time: International trends, theory and policy perspectives, Lonnie Golden and Deb Figart, eds.

2007, "Why economists dislike a lump of labor," Review of Social Economy, Vol. 65, Iss. 3.

There is also a bit of an update and background in a couple of blog posts at EconoSpeak:

Sandwichman's Lump-of-Labor Odyssey

Sandwichman's Lump-of-Labor Odyssey, Part II

I expect that I will take the occasion of your recent lecture on migration as an opportunity to post a third part of the odyssey, in which I may discuss the reception (of lack of any) of my research by folks who keep beating the old lump of labour drum. It would be delightful if I could get a response from you to my rebuttal of the fallacy claim. I don't pretend to be the first to rebut this claim, among my predecessors are A. C. Pigou and Maurice Dobb who both characterized the "fixed Work-fund fallacy" claim as itself an ignoratio elenchi fallacy. Looking forward to your reply.

Sincerely,

Tom Walker

P.S [in separate emai]:

By the way, Alan, I have now watched the video of your talk and reviewed your power point and it is otherwise a fine presentation. The lump of labour interpretation of your background information is not grounded in your research, which doesn't really investigate the relationship between the empirical findings and people's alleged tacit theories about the labor market. Essentially, your interpretation, then, is speculative and extraneous to your empirical evidence.

This may seem like a trivial matter but I think not. You mention Trump's demagoguery on immigration in passing. Obviously, disparaging a hypothetical fallacy is not persuasive to Trump's audience who view it as condescending. Have you considered that their perspectives might not be driven by the assumption of a fixed amount of work but by a disappointed expectation that they should have "gotten ahead" more than in fact they did? Whether or not such expectations are realistic, it seems to me a more plausible assumption than that there is a fixed amount of work in the economy as a whole. What do you think?

Cheers,

Tom Walker

I want to emphasize again the bolded line in my postscript to Professor Manning. In his lecture, Manning envisions a scenario where somebody doesn't get a job and thinks to himself, "if it wasn't for that person over there I would have gotten that job." While true for that individual, such experience has very little to do with the level of employment in the economy as a whole. My alternative suggestion has to do, though, with an individual experience that cannot be contradicted by Manning's empirical evidence. While the total number of jobs may expand following growth in the labor supply, what evidence is there that promotions and pay increases will live up to people's expectations? None. And even if those expectations were, in fact, "unrealistic" what empirical evidence is there that they were unrealistic? None.

The above would make a worthwhile research project. Meanwhile, Paul Krugman still hasn't replied to the open letter I sent him (hard copy postally) nearly five years ago.

Friday, January 22, 2016

How Could Anybody Question That Low Oil Prices Lead To Low, Stock Prices?

On 1/17/16 Olivier Blanchard posted a piece entitled "The Price of Oil, China, and Stock Market Herding," which was picked by Mark Thoma at Economists View. Here are two quotes from Blanchard's piece:

"Yet the headlines are now about how low oil prices lead to low stock prices."

then later in it:

"I believe that to a large extent, herding is at play"

I cannot agree more. What has me ratttled on this and leading me to pile on is that the media seem to really believe this. If one had only looked at daily market reports and TV and other media news headlines, this supposed tight link has simply become what they all say right up front without even a shadow of a question or doubt, even though as Blanchard notes most economists have long believed and argued that it is other way around: low oil prices generally lead to high stock prices. But not now, and they seem to have lost all awareness of this older truth that dates back the stagflationary "oil price shocks" of the 1970s.

So, this is not only still happening but getting worse. I just checked the markets. Good news! Oil price up and the stock market is sharply rising right now as I write this, at least as of a few minutes ago, and this happened yesterday, following the day before when oil fell being below $30 per barrel and fell and the market fell hard (along with ones around the world, especially in China). Reality of this tight link, confirmed, and right now the news is good, supposedly.

OK, for a second let me note that most have been observing for decades the irony that in the long run higher oil prices are good by helping us get off polluting fossil fuels, even as in the short run it tends to a stagflationary effect: higher inflation and higher unemployment as real growth slows or even goes negative into recession.

Indeed this past played an important role in the recent history of macroeconomics. In the 60s we had the Phillips Curve. Funny thing is that for all the rejections of it, it is back, and pretty clearly underlying the recent Fed rate hike has been some deep deep hankering at the Fed for the Phillips Curve. They had themselves screwed up to raising rates in September, but then China went blooey and later reports made it clear that Yellen managed to postpone a vote for that at FOMC by personally cutting a deal with crucial FOMC members that if the job market did well in the fall, the rate hike would happen, and indeed the job market did well, so Yellen had to keep her promise and the FOMC vote to raise rates in December was reportedly a unanimous vote.

A bit of irony on this is that initial rejection of the 60s version of the Phillips Curve during the 70s that coincided with the victory of the new classical approach was reinforced by the oil price shocks of 1973 and 1979. So in 1968 Friedman and Phelps and others declared the existence of a long-run natural rate of unemployment at which point the long-run Phillips Curve would be vertical (and would also magically equal the auspicious NAIRU as well, although this never had a solid argument supporting it). Later this argument would be reinforced by rational expectations that would say that rational agents would all know indeed where that natural rate was, thereby precluding any meaningful downward slope of it, which would only appear as fools with inaccurate expectations would behave in a silly way. Get thee hence, oh Keynesian Phillips Curve, you silly delusion fooling the wise new macroeconomists and policymakers.

Now many at the time and again later in the 80s, including all Post Keynesians and some more standard people like Larry Summers (and even Phelps always allowed for this as a big caveta), that unemployment is endogenous through hysteresis and other issues, that there are multiple equilibria, and even the original ratex people knew this so it depends on some kind of coordination among agents on a focal point, with no clear mechanism for how this would be achieved. The usual standard stories, usually only periodically told in an offhand manner amounted to either that it is the job of central banks to effectuate this selecting of the coordinated equilibrium, or somehow or other one of these outcomes indeed gets to be privileged over the others, the really true natural rate/NAIRU that everybody should know, if only those pesky macro policymakers would just leave things alone and keep inflation under control, screw any fiscal or other policy effort to reduce unemployment, doomed so clearly that in many seminar rooms anybody talking such things would be snickered about in corners of the "better" seminar rooms, tsk tsk.

Now we have since seen at two clear violations of this garbage, which I never accepted (along with many others such as Jamie Galbraith and Dean Baker). One was in the mid-90s when Yellen and Greenspan decided that good supply side conditions made it possible to continue lowering the fed funds rate even as the unemployment rate plummeted to the then "estimated natural rate." Sure enough, instead of the dreaded NAIRU kicking in with an uptick in inflation, both inflation and unemployment continued to fall, the very opposite of the stagflationary 1970s. These people did sometimes note that one of the favorable supply side conditions holding in the late 90s was a very low oil price that stayed low., only starting to rise again after 2001.

The other is the more obvious evidence for presence of unemployment hysteresis and no NAIRU whatsoever since 2008r. Highly stimulative monetary policy over a long time, publicly supported by Krugman and many others (zero bound and all that), but implemented by Bernanke and Yellen, to long and loud and howling by inflationistas. Indeed, the December hike looks like those hysterical fools finally getting their say at the FOMC, even as the rate of inflation was continuing to decline even as employment was improving, curiously an effective assertion of a newly dominant Phillips Curve, even though we were supposed to have gotten over such silly things decades ago.

Going back to the 60s and 70s, even the original paper by Samuelson and Solow on the Phillips Curve, while they recommended taking it at least somewhat seriously in the short run, they had numerous caveats, which Samuelson would reproduce regularly in his Principles textbook. So, when the oil price shocks hit after 1973 and we saw both inflation and unemployment rates rising, the actually existing stagflation that the Friedman-Phelps-Lucas gang would jump on to declare the end of the Phillips Curve and the triumph of those obviously rare times when wicked and ignorant policymakers would try to stimulate the economy and push unemployment below the natural rate/NAIRU, Samuelson and others would talk about the "Phillips Curve shifting outward" dud to the supply side conditions. Baumol and Blinder soon introduced garden variety AS/AD analysis into their Principles textbooks to more directly take account of these bad things that can happen to your economy due to rising oil prices. For quite a few editions, Samuelson held out with focusing on the Keynesian Cross and then bringing in a verbal story about how the rising oil prices would shift out the Phillips Curve, which clearly was sufficient to explaining the stagflation, even as new classicals saw the stagflation as somehow throwing Phillips Curves out the window except for when wicked policymakers tried to employment do better than the sacred natural rate, shame on them, tricking all those poor sucker agents not coordinating on the one true natural rate/NAIRU.

So that is the story, and I am sticking to it, and I think Blanchard basically agrees with it, which means that the current situation where low oil prices mean low stock market prices and vice versa is simply insane. It is only explicable by some herding speculative frenzy, because even though certainly oil producers/exporters suffer. But long studies by such people like my friend Jim Hamilton have long since verified that there are more oil importers and consumers, so the benefits to them in real terms of lower oil prices way outweigh the damage to those producer/exporters (let us all now weep for Russia, Saudi Arabia, and Iran).

My own initial take on this dates back to 1969, when I wrote a senior honors undergrad thesis at the University of Wisconsin-Madison, titled,"A History of Oil Price Changes in the Middle East." I forecast that OPEC would gain market power in the future. This then came to pass in 1973 oil price shock, triggered substantially by oil export quotas and production cuts.by OPEC. I later published on all this.

By the time of the second big oil price shock in 1979, which followed the fall of the Shah of Iran, which was followed by a reduction of oil production in Iran from 6 million barrels per day to 600,000 (with the Saudis trying to offset that, but they could only increase their production by about 2 mbd, not enough do the trick, so the price of oil tripled in a short space of time, the second of the big "oil price shocks" that was followed by another surge of stagflation in the oil importing economies.

Following this I appeared on a few panels debating the sources of inflation. Post Keynesians liked to allow for "cost-push" supply side inflation effects (see oil price shocks above), and given my past work I thought that looked pretty reasonable, but others on these panels where Chicago style Friedman monetarists, one an actual student of old Uncle Miltie himself, for whom all this was due excess monetary growth. Could not have anything to do with a monopoly power induced oil price increase, because, hey, the price of oil is a mere relative micro price. It cannot drive inflation, and any inflation that appears to be coming from it is really ultimately dues to bad monetary policymakers not following his steady growth of M rule (which would lie it tatters by the end of the 1980s). But, hey, who is keeping track? (although before he died Friedman admitted his old rule no longer held and he advocated using interest rates to target inflation instead).

Getting more personal, this is my first blogpost since I had open heart surgery on Jan. 5. I am at least partly back and trying to do professional things, but very weak and having to take two tylenols every four hours to keep the pain in my chest under control I still need a lot of rest, and I have very low stamina and energy. Nevertheless I am in much better than most people two and a half weeks after they had open heart surgery (it was an aortic valve replacement).

Finally, and somewhat ironically I am writing this in my house in Harrisonburg, Virginia, where it has been snowing sin 10:45 AM as part of the Jonas winter storm, and we are the "bullseye" according to the Weather Channel. Really. Go look at the channel and see where it is not only going to be more than two feet, but this morning I watched Jim Cantore (who is in Washington) ask the guy in Atlanta, "What is that while spot in the middle there?" The answer was that it is the tiny spot where there maybe more than three feet. They showed a white arrow pointing at what they called the "bullseye," and, yes, Harrisonburg, Virginia is smack dab center in it with the Weather Channel mentioning our location by name.

The only good side is that we shall not officially be in blizzard territory tomorrow afternoon, which is being forecast for Washington. That needs a sufficiently high wind, and the mountain ridges surrounding the Shenandoah Valley will have those winds, but down here in the valley itself the mountains will protect us from the highest winds, and our high winds will just fall short of putting us into the official blizzard category. But we are likely to be at or very near the highest aggregate snowfall total off all for Jonas.

As it is, it is very pretty to watch, very heavily coming down now, although with the wind not bad yet. And, yes, we about as well prepared as we can be all stocked up on everything, firewood by the fireplace in case the power goes out for a long time tomorrow afternoon. My only regret is that due to my recent heart surgery I cannot help with the shoveling that most on our street are out doing trying to keep those totals from getting too bad before it is all over.

So, I wish all of you, my friends and others, all the best, especially if you are going to be affected by Jonas, but also all of you around the world wherever you are who are not going to be directly affected by this snow.

Barkley Rosser

"Yet the headlines are now about how low oil prices lead to low stock prices."

then later in it:

"I believe that to a large extent, herding is at play"

I cannot agree more. What has me ratttled on this and leading me to pile on is that the media seem to really believe this. If one had only looked at daily market reports and TV and other media news headlines, this supposed tight link has simply become what they all say right up front without even a shadow of a question or doubt, even though as Blanchard notes most economists have long believed and argued that it is other way around: low oil prices generally lead to high stock prices. But not now, and they seem to have lost all awareness of this older truth that dates back the stagflationary "oil price shocks" of the 1970s.

So, this is not only still happening but getting worse. I just checked the markets. Good news! Oil price up and the stock market is sharply rising right now as I write this, at least as of a few minutes ago, and this happened yesterday, following the day before when oil fell being below $30 per barrel and fell and the market fell hard (along with ones around the world, especially in China). Reality of this tight link, confirmed, and right now the news is good, supposedly.

OK, for a second let me note that most have been observing for decades the irony that in the long run higher oil prices are good by helping us get off polluting fossil fuels, even as in the short run it tends to a stagflationary effect: higher inflation and higher unemployment as real growth slows or even goes negative into recession.

Indeed this past played an important role in the recent history of macroeconomics. In the 60s we had the Phillips Curve. Funny thing is that for all the rejections of it, it is back, and pretty clearly underlying the recent Fed rate hike has been some deep deep hankering at the Fed for the Phillips Curve. They had themselves screwed up to raising rates in September, but then China went blooey and later reports made it clear that Yellen managed to postpone a vote for that at FOMC by personally cutting a deal with crucial FOMC members that if the job market did well in the fall, the rate hike would happen, and indeed the job market did well, so Yellen had to keep her promise and the FOMC vote to raise rates in December was reportedly a unanimous vote.

A bit of irony on this is that initial rejection of the 60s version of the Phillips Curve during the 70s that coincided with the victory of the new classical approach was reinforced by the oil price shocks of 1973 and 1979. So in 1968 Friedman and Phelps and others declared the existence of a long-run natural rate of unemployment at which point the long-run Phillips Curve would be vertical (and would also magically equal the auspicious NAIRU as well, although this never had a solid argument supporting it). Later this argument would be reinforced by rational expectations that would say that rational agents would all know indeed where that natural rate was, thereby precluding any meaningful downward slope of it, which would only appear as fools with inaccurate expectations would behave in a silly way. Get thee hence, oh Keynesian Phillips Curve, you silly delusion fooling the wise new macroeconomists and policymakers.

Now many at the time and again later in the 80s, including all Post Keynesians and some more standard people like Larry Summers (and even Phelps always allowed for this as a big caveta), that unemployment is endogenous through hysteresis and other issues, that there are multiple equilibria, and even the original ratex people knew this so it depends on some kind of coordination among agents on a focal point, with no clear mechanism for how this would be achieved. The usual standard stories, usually only periodically told in an offhand manner amounted to either that it is the job of central banks to effectuate this selecting of the coordinated equilibrium, or somehow or other one of these outcomes indeed gets to be privileged over the others, the really true natural rate/NAIRU that everybody should know, if only those pesky macro policymakers would just leave things alone and keep inflation under control, screw any fiscal or other policy effort to reduce unemployment, doomed so clearly that in many seminar rooms anybody talking such things would be snickered about in corners of the "better" seminar rooms, tsk tsk.

Now we have since seen at two clear violations of this garbage, which I never accepted (along with many others such as Jamie Galbraith and Dean Baker). One was in the mid-90s when Yellen and Greenspan decided that good supply side conditions made it possible to continue lowering the fed funds rate even as the unemployment rate plummeted to the then "estimated natural rate." Sure enough, instead of the dreaded NAIRU kicking in with an uptick in inflation, both inflation and unemployment continued to fall, the very opposite of the stagflationary 1970s. These people did sometimes note that one of the favorable supply side conditions holding in the late 90s was a very low oil price that stayed low., only starting to rise again after 2001.

The other is the more obvious evidence for presence of unemployment hysteresis and no NAIRU whatsoever since 2008r. Highly stimulative monetary policy over a long time, publicly supported by Krugman and many others (zero bound and all that), but implemented by Bernanke and Yellen, to long and loud and howling by inflationistas. Indeed, the December hike looks like those hysterical fools finally getting their say at the FOMC, even as the rate of inflation was continuing to decline even as employment was improving, curiously an effective assertion of a newly dominant Phillips Curve, even though we were supposed to have gotten over such silly things decades ago.

Going back to the 60s and 70s, even the original paper by Samuelson and Solow on the Phillips Curve, while they recommended taking it at least somewhat seriously in the short run, they had numerous caveats, which Samuelson would reproduce regularly in his Principles textbook. So, when the oil price shocks hit after 1973 and we saw both inflation and unemployment rates rising, the actually existing stagflation that the Friedman-Phelps-Lucas gang would jump on to declare the end of the Phillips Curve and the triumph of those obviously rare times when wicked and ignorant policymakers would try to stimulate the economy and push unemployment below the natural rate/NAIRU, Samuelson and others would talk about the "Phillips Curve shifting outward" dud to the supply side conditions. Baumol and Blinder soon introduced garden variety AS/AD analysis into their Principles textbooks to more directly take account of these bad things that can happen to your economy due to rising oil prices. For quite a few editions, Samuelson held out with focusing on the Keynesian Cross and then bringing in a verbal story about how the rising oil prices would shift out the Phillips Curve, which clearly was sufficient to explaining the stagflation, even as new classicals saw the stagflation as somehow throwing Phillips Curves out the window except for when wicked policymakers tried to employment do better than the sacred natural rate, shame on them, tricking all those poor sucker agents not coordinating on the one true natural rate/NAIRU.

So that is the story, and I am sticking to it, and I think Blanchard basically agrees with it, which means that the current situation where low oil prices mean low stock market prices and vice versa is simply insane. It is only explicable by some herding speculative frenzy, because even though certainly oil producers/exporters suffer. But long studies by such people like my friend Jim Hamilton have long since verified that there are more oil importers and consumers, so the benefits to them in real terms of lower oil prices way outweigh the damage to those producer/exporters (let us all now weep for Russia, Saudi Arabia, and Iran).

My own initial take on this dates back to 1969, when I wrote a senior honors undergrad thesis at the University of Wisconsin-Madison, titled,"A History of Oil Price Changes in the Middle East." I forecast that OPEC would gain market power in the future. This then came to pass in 1973 oil price shock, triggered substantially by oil export quotas and production cuts.by OPEC. I later published on all this.

By the time of the second big oil price shock in 1979, which followed the fall of the Shah of Iran, which was followed by a reduction of oil production in Iran from 6 million barrels per day to 600,000 (with the Saudis trying to offset that, but they could only increase their production by about 2 mbd, not enough do the trick, so the price of oil tripled in a short space of time, the second of the big "oil price shocks" that was followed by another surge of stagflation in the oil importing economies.

Following this I appeared on a few panels debating the sources of inflation. Post Keynesians liked to allow for "cost-push" supply side inflation effects (see oil price shocks above), and given my past work I thought that looked pretty reasonable, but others on these panels where Chicago style Friedman monetarists, one an actual student of old Uncle Miltie himself, for whom all this was due excess monetary growth. Could not have anything to do with a monopoly power induced oil price increase, because, hey, the price of oil is a mere relative micro price. It cannot drive inflation, and any inflation that appears to be coming from it is really ultimately dues to bad monetary policymakers not following his steady growth of M rule (which would lie it tatters by the end of the 1980s). But, hey, who is keeping track? (although before he died Friedman admitted his old rule no longer held and he advocated using interest rates to target inflation instead).

Getting more personal, this is my first blogpost since I had open heart surgery on Jan. 5. I am at least partly back and trying to do professional things, but very weak and having to take two tylenols every four hours to keep the pain in my chest under control I still need a lot of rest, and I have very low stamina and energy. Nevertheless I am in much better than most people two and a half weeks after they had open heart surgery (it was an aortic valve replacement).

Finally, and somewhat ironically I am writing this in my house in Harrisonburg, Virginia, where it has been snowing sin 10:45 AM as part of the Jonas winter storm, and we are the "bullseye" according to the Weather Channel. Really. Go look at the channel and see where it is not only going to be more than two feet, but this morning I watched Jim Cantore (who is in Washington) ask the guy in Atlanta, "What is that while spot in the middle there?" The answer was that it is the tiny spot where there maybe more than three feet. They showed a white arrow pointing at what they called the "bullseye," and, yes, Harrisonburg, Virginia is smack dab center in it with the Weather Channel mentioning our location by name.

The only good side is that we shall not officially be in blizzard territory tomorrow afternoon, which is being forecast for Washington. That needs a sufficiently high wind, and the mountain ridges surrounding the Shenandoah Valley will have those winds, but down here in the valley itself the mountains will protect us from the highest winds, and our high winds will just fall short of putting us into the official blizzard category. But we are likely to be at or very near the highest aggregate snowfall total off all for Jonas.

As it is, it is very pretty to watch, very heavily coming down now, although with the wind not bad yet. And, yes, we about as well prepared as we can be all stocked up on everything, firewood by the fireplace in case the power goes out for a long time tomorrow afternoon. My only regret is that due to my recent heart surgery I cannot help with the shoveling that most on our street are out doing trying to keep those totals from getting too bad before it is all over.

So, I wish all of you, my friends and others, all the best, especially if you are going to be affected by Jonas, but also all of you around the world wherever you are who are not going to be directly affected by this snow.

Barkley Rosser

Thursday, January 21, 2016

Can we breath again?

Alexander Lowen, founder of the International Institute for Bioenergetic Analysis (IIBA), wrote “It is a common belief that we breathe with our lungs alone, but in point of fact, the work of breathing is done by the whole body." [1]

But Mr Lowen may not have been fully cognisant at the time that it is ultimately our earth that 'breathes'. Our atmosphere of 78% nitrogen, 21% oxygen and 0.03% carbon dioxide has come about because of our planet's emergence of the presence of life itself says a former chairman of the IPCC's Science Working Group. [2]

Planet earth has breath. Her unconscious goal, claims James Lovelock, is to maintain a planet fit for life and "if humans stand in the way of this, we shall be eliminated with as little pity as would be shown by the micro-brain of an intercontinental ballistic nuclear missile in full flight to its target."

In June last year Yadigar Sekerci and Sergei Petrovskii published a paper published in the Bulletin of Mathematical Biology. More than half the world's oxygen, they write, comes from ocean life. If that ocean life dies then rising sea levels and drowning won't be our demise. Rather, we will simply all suffocate.

"consider this" Petroviskii warns, " ...we may advance into the future fooled by the response of plankton. As the world warms, plankton could appear to thrive, providing lots of oxygen, and sequestering more carbon dioxide. We all cheer. Apologists tell us our worries were overblown. But then, a limit beyond sustainable cycles is reached, and plankton world-wide could experience a mass die-off. ...."catastrophe "occurs. Maybe the model is wrong. Maybe our civilization is wrong...."But the earth is still alive for us. Its ecosystems and the environment are one organism. How incredible is it then to be contemplating tonight the possibility that our group consciousness and our emotions form yet another unity with out planet:

"Studies at Princeton University have suggested that two or more minds that hold the same thought or emotion simultaneously may have a tangible effect on physical surroundings. The power of thought is not just ideological. It manifests physically. Cohesion between individuals ramps up this power...." [3]Roger Nelson is the director of the Global Consciousness Project, which is a collaboration between researchers worldwide to test the power of human consciousness. Just as climate scientists in the 1990s discovered the history of earth's abrupt climate change, other researchers began to show that the human mind could influence the actions of a machine. An emotional bond between human individuals enhanced this power.

So could earth's disharmony be revealing who we really are? Have we thought our way into a dark struggle against extinction?

Can we can wish for change? Can we, as Ghandi claimed, be the change that we wish to see on earth?

REFERENCES:

[1] Alexander Lowen.

http://www.goodreads.com/author/show/243384.Alexander_Lowen

[2] Sir John Houghton. Page 201 'Global Warming - The Complete Briefing' Third Edition, Cambridge University Press. 2004. ISBN 0 521 52874 7

[3] Evidence Group Consciousness May Have a Physical Effect on the World

By Tara MacIsaac, Epoch Times | June 16, 2015

http://www.theepochtimes.com/n3/1393821-evidence-group-consciousness-may-have-a-physical-effect-on-the-world/

Wednesday, January 20, 2016

Fact Checking the Track Record

UPDATE: According to this, not having a CIB is no proof of not having been in combat.

The Sandwichman is no authority on discharge papers and combat badges. I am wondering, though, about the relationship between Track Palin's PTSD and his combat experience in Iraq. Can anyone confirm or refute the following discussion?

The Sandwichman is no authority on discharge papers and combat badges. I am wondering, though, about the relationship between Track Palin's PTSD and his combat experience in Iraq. Can anyone confirm or refute the following discussion?

Monday, January 18, 2016

A Short Comment on the Political Economy of Various Reforms, Including Health Care

The default assumption of much of the reformist left seems to be that elite economic opposition to progressive policy is concentrated in the industry or industries most directly affected. So, to take an example, the challenge in moving toward a single payer system of health insurance is overcoming the resistance of the existing health insurance industry, the medical establishment, etc. Similarly, what stands between us and rational policy on climate change is the fossil fuel industry.

This is an optimistic view, since it implies that the other economic interests are at least neutral to reform and may even be won over as part of a broad progressive coalition.

My reading of the last few decades of political conflict contradicts this: I don’t think we should expect to isolate a fragment of capital through careful sculpting of policy options. This expectation failed in both the Clinton and Obama health care initiatives (although the latter had partial legislative success), and the experience of carbon politics under Obama, while less clear, points in the same direction.

Why this is the case is open for debate. I suspect that the financialization of nonfinancial corporations has something to do with it, as well as the general changes in the portfolios of UHNWI’s, but this is just a guess.

This is an optimistic view, since it implies that the other economic interests are at least neutral to reform and may even be won over as part of a broad progressive coalition.

My reading of the last few decades of political conflict contradicts this: I don’t think we should expect to isolate a fragment of capital through careful sculpting of policy options. This expectation failed in both the Clinton and Obama health care initiatives (although the latter had partial legislative success), and the experience of carbon politics under Obama, while less clear, points in the same direction.

Why this is the case is open for debate. I suspect that the financialization of nonfinancial corporations has something to do with it, as well as the general changes in the portfolios of UHNWI’s, but this is just a guess.

The Future of Jobs: Recommendations for Action

The Davos World Economic Forum has labored mightily to bring forth a report on The Future of Jobs, which contains the following "Recommendations for Action":

While the implications of accelerating disruptive change to business models are far-reaching—even daunting— for employment and skills, rapid adjustment to the new reality and the opportunities it offers is possible, provided there is concerted effort by all stakeholders. For government, it will entail innovating within education and labour-related policymaking, requiring a skills evolution of its own. For the education and training sector, it will mean vast new business opportunities as it provides new services to individuals, entrepreneurs, large corporations and the public sector. The sector may become a noteworthy new source of employment itself.

For businesses to capitalize on new opportunities, they will need to put talent development and future workforce strategy front and centre to their growth. Firms can no longer be passive consumers of ready-made human capital. They require a new mindset to meet their talent needs and to optimize social outcomes. This entails several major changes in how business views and manages talent, both immediately and in the longer term. In particular, there are four areas with short term implications and three that are critical for long term resilience...

May I summarize? In point form, then:

Paul Krugman, Bernie Sanders, and Medicare for All

The website for Dean Baker's organization, the Center for Economic and Policy Research, is under attack. In light of the urgency of the issue, Dean has asked the management to post this here.

BY DEAN BAKER, CENTER FOR ECONOMIC AND POLICY RESEARCH

Paul Krugman weighs in this morning on the debate between Bernie Sanders and Hillary Clinton as to whether we should be trying to get universal Medicare or whether the best route forward is to try to extend and improve the Affordable Care Act. Krugman comes down clearly on the side of Hillary Clinton, arguing that it is implausible that we could get the sort of political force necessary to implement a universal Medicare system.

Getting universal Medicare would require overcoming opposition not only from insurers and drug companies, but doctors and hospital administrators, both of whom are paid at levels two to three times higher than their counterparts in other wealthy countries. There would also be opposition from a massive web of health-related industries, including everything from manufacturers of medical equipment and diagnostic tools to pharmacy benefit managers who survive by intermediating between insurers and drug companies.

Krugman is largely right, but I would make two major qualifications to his argument. The first is that it is necessary to keep reminding the public that we are getting ripped off by the health care industry in order to make any progress at all. The lobbyists for the industry are always there. Money is at stake if they can get higher prices for their drugs, larger compensation packages for doctors or hospitals, or weaker regulation on insurers.

The public doesn’t have lobbyists to work the other side. The best we can hope is that groups that have a general interest in lower health care costs, like AARP, labor unions, and various consumer groups can put some pressure on politicians to counter the industry groups. In this context, Bernie Sanders’ push for universal Medicare can play an important role in energizing the public and keeping the pressure on.

Those who think this sounds like stardust and fairy tales should read the column by Krugman’s fellow NYT columnist, health economist Austin Frakt. Frakt reports on a new study that finds evidence that public debate on drug prices and measures to constrain the industry had the effect of slowing the growth of drug prices. In short getting out the pitchforks has a real impact on the industry’s behavior.

The implication is that we need people like Senator Sanders to constantly push the envelope. Even if this may not get us to universal Medicare in one big leap, it will create a political environment in which we can move forward rather than backward.

The other point has to do with an issue that Krugman raises in his blogpost on the topic. He argues that part of the story of lower health care costs in Canada and other countries involves saying “no,” by which he means refusing to pay for various drugs and treatments that are considered too expensive for the benefit they provide.

While there is some truth to this story, it is important to step back for a moment. In the vast majority of cases, the drugs in question are not actually expensive to manufacture. The way the drug industry justifies high prices is that they must recover their research costs. While the industry does in fact spend a considerable amount of money on research (although they likely exaggerate this figure), at the point the drug is being administered this is a sunk cost. In other words, the resources devoted to this research have already been used; the economy doesn’t somehow get back the researchers’ time and the capital expended if fewer people take a drug that is developed from their work.

Ordinarily economists treat it as an absolute article of faith that we want all goods and services to sell at their marginal cost without interference from the government, like a trade tariff or quota. However in the case of prescription drugs, economists seem content to ignore the patent monopolies granted to the industry, which allow it to charge prices that are often ten or even a hundred times the free market price. (The hepatitis C drug Sovaldi has a list price in the United States of $84,000. High quality generic versions are available in India for a few hundred dollars per treatment.) In this case, we are effectively looking at a tariff that is not the 10-20 percent that we might see in trade policy, but rather 1,000 percent or even 10,000 percent.

This sort of gap between price and marginal cost leads to exactly the sort of distortions that economists predict when the government intervenes in a market with trade tariffs, except the distortions are hugely larger with drugs. Companies have incentive to engage in massive marketing efforts, they push their drugs for conditions for which they may not be appropriate, and they conceal evidence suggesting their drugs may be less effective than advertised, or possibly even harmful. They also lobby politicians for ever longer and stronger patent protection, and they use the legal system to harass potential competitors, both generic and brand. Even research is distorted by this incentive structure, with large portions of the industry’s budget being devoted to developing copycat drugs to gain a share of a competitor’s patent rents.

Perhaps the worst part of this story is that the patent monopolies put us in a situation where we might have to say no. The industry’s monopoly allows it to say that it will not turn over a life-saving drug for less than $100,000, $200,000, or whatever price tag it chooses. However, if there was no patent monopoly, we would be looking at buying this drug at its cost of production. That will rarely be more than $1,000 and generally much less. At those prices, it will rarely make sense to say no. (The same issue arises with most medical equipment – once we have the technology, producing an MRI is relatively cheap, as would be the cost of an individual screening.)

We do have to pay for the research, but the way we are now doing it is incredibly backward. It is like paying the firefighters when they show up at the burning house with our family inside. Of course we would pay them millions to save our family (if we had the money), but it is nutty to design a system that puts us in this situation.

We should be looking for a system that pays for the research upfront. There are various mechanisms to accomplish this goal. (Here’s my plan for a system of publicly funded clinical trials.) Obviously overhauling our system for financing drug research is not something that is done overnight, but it is an issue that needs attention. The current system is incredibly wasteful and it needlessly puts in a situation where we have to say no in contexts where the costs to society of administering treatment are actually very low.

This doesn’t mean that we would pay for everything for everybody. There are some procedures that actually are very expensive, for example surgeries requiring many hours of the time of highly skilled surgeons. But we should be trying to design a system that minimizes these sorts of situations, rather than making them an everyday occurrence.

Sunday, January 17, 2016

"Degrowth," Economic Myths and a Minimal Bioeconomic Program

«La décroissance est un mot-obus.»La Décroissance is a "missile" word, a "bombshell" word -- that is to say, it is a provocation. As Serge Latouche put it, "The idea of a contraction-based society is just a way to provoke thought about alternatives." The meaning of the English word, 'degrowth,' has been lost in translation. It is, literally, a double translation whose source has often been misplaced.

In 1979, Jacques Grinevald and Ivo Rens translated into French Nicholas Georgescu-Roegen's 1975 article, "Energy and Economic Myths", along with two articles on bioeconomics in a book titled Demain La Décroissance: Entropie – Écologie – Économie. The second edition omitted Demain from the title. Several authors have incorrectly identified the book as a translation of The Entropy Law and the Economic Process, which it is not.

In Grinevald and Rens's translation, the word décroissance first appears in the text at the end of the penultimate paragraph of a section titled, L' état stable: un mirage à la mode, originally, "The steady state: a topical mirage":