When I discussed government purchases during FDR’s first two terms as President, I opened with something from Paul Krugman. Alex Tabarrok graced our blog with this comment:

Here from HSUS is Federal Spending by year - note by 1934 spending had more than doubled in nominal terms.

Maybe I should acknowledge something else Paul had to say:

So I caught Governor Schwarzenegger on TV, talking fiscal crisis, and found myself thinking about fiscal stupidity. Economists may remember that the president of the European Commission once called the eurozone’s “stability pact,” which was supposed to set a rigid limit on budget deficits, the “stupidity pact” - because it would have forced tax hikes and spending cuts in the middle of a recession. Well, we’ve got our own stupidity pact: state and local governments operate under fiscal rules that lead to booming spending and tax cuts when the economy is strong and the reverse when the economy is weak. This is bad governance: services are cut precisely when people need them most. It’s also bad macroeconomics: it exacerbates the business cycle. Right now, we’re seeing a sharp drop in state revenues, which is going to lead to big cutbacks in spending and tax increases at exactly the wrong time.

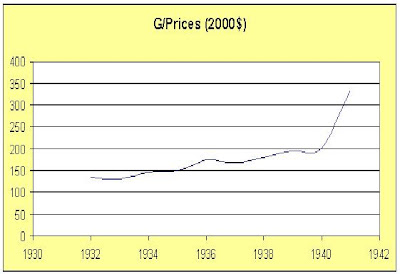

While Alex is focused on Federal expenditures and revenues, my original graph looked at total government purchases. Expenditures include both purchases and transfer payments but looking at Federal figures omits what was happening at the state & local level. But let me give even more credit to Marmico who sent us to a series of Federal expenditures and revenues as percentages of GDP, which our first graph depicts for the 1930 to 1941 period. Expenditures (outlays) rose relative to GDP from 1930 to 1934 but this was more due to a drop in real GDP than skyrocketing real spending. Federal receipts (taxes) did rise as a share of GDP from 1932 to 1938 while outlays as a share of GDP fell from 1934 to 1938. Federal fiscal policy wasn’t exactly doing what Keynes would recommend in his 1936 General Theory until after the 1938 recession.

Our second graph – which represents the reason for this post – shows a historical example of what currently concerns Paul – falling state & local revenues (as a share of GDP) combined with the tendency for state & local governments to annually balance their budgets, which translates into reduced expenditures (as a share of GDP). And given the fact that state & local expenditures were often greater than Federal expenditures before World War II, the pro-cyclical nature of state & local fiscal policy could have easily dominated any timid attempt at countercyclical fiscal policy from the Federal government – even if FDR had more wisdom and courage to try what Keynes came to recommend.