The eurogroup finance ministers can’t take it any more: they want Yanis Varoufakis out of their sight, banished to the netherworld of YouTube and the blogosphere. He keeps insisting that policy reforms can’t be given fiscal numbers without a credible macroeconomic forecast, which might be something for academic perfectionists, but not for grownups who have to deal with reality, like who is facing default and has to get with the program, pronto. How can Greece claim it can’t pay its debts when there are still wages and pensions to cut?

So the Greek government said, fine, you don’t want to look at Varoufakis, we’ll make his deputy the negotiating guy, but Varoufakis will still be the team leader. Maybe the deputy tucks in his shirt.

I wonder why Greece didn't try out this idea: give Varoufakis a new identity. Change his name to “the institutions”, as in, you don’t have to deal with the Troika any more but now you have to submit to “the institutions”. OK, that’s a bit strange for a personal moniker, but you could call him Charlie or Wolfgang or, hell, Maynard. “Dear finance ministers, we have accepted your request to sack Varoufakis. From now on you will be negotiating with 'Maynard.'”

Monday, April 27, 2015

Morning in America and Cameron’s Productivity Pessimism

I feel over 30 years younger. A recent UK debate reminds me of the infamous Reagan commercial - it’s Morning in America again. You see the Reagan tax cuts saved America from that awful 1982 recession under Jimmy Carter. Oh wait – Reagan became President before the 1982 recession. Of course the macroeconomic mix back then involved Reagan’s fiscal stimulus and a very vigorous monetary contraction with the recovery coming after the Volcker FED declared victory over inflation and eased up. The Bank of England of late has been using monetary stimulus desperately trying to offset Cameron’s vigorous fiscal austerity. And the intellectual garbage coming from Cameron’s government is being documented by Simon Wren Lewis:

The idea that austerity during the first two years of the coalition government was vindicated by the 2013 recovery is so ludicrous that it is almost embarrassing to have to explain why … imagine that a government on a whim decided to close down half the economy for a year. That would be a crazy thing to do, and with only half as much produced everyone would be a lot poorer. However a year later when that half of the economy started up again, economic growth would be around 100%. The government could claim that this miraculous recovery vindicated its decision to close half the economy down the year before. That would be absurd, but it is a pretty good analogy with claiming that the 2013 recovery vindicated 2010 austerity.This FRED chart shows what Simon is referring to. A deep recession followed by a partial recovery with real GDP at only 1.037 of its 2007 level and real income per capita still below its level from 7 years ago. The UK economy is imitating the US macroeconomic performance 30 years ago. In 1983, we were still far below full employment but Cameron has found a bogus estimate of potential output in the UK that say they are just fine. Paul Krugman explains:

these estimates are now based on estimates of potential output, which purport to show that the British economy in 2006-7 was hugely overheated and operating far above sustainable levels. But nothing one saw at the time was consistent with this view. In particular, there was no sign of inflationary overheating. So why do the usual suspects claim that Britain had a large positive output gap? The answer is that the statistical techniques used by most of the players here automatically reinterpret any prolonged slump as a slowdown in the growth of potential output — and because they also smooth out potential output, the supposed fall in current potential propagates back into the past, making it seem as if the pre-crisis economy was wildly overheated.Bill Martin has been following this debate for a while:

There are two sharply contrasting explanations for the continuing malaise. The conjunction of weak activity, persistent inflation and disappointing trade performance adds weight to the common view that the economy has become bound to a lower trajectory, the result of a permanent loss of productive capacity. Others believe the economy is primarily constrained by weak demand, the result of a private debt overhang and a contraction in the flow of bank credit, deflationary forces made worse by an upsurge in world commodity prices.Bill comes down on the latter explanation as does Paul and Simon. The former view is a Real Business Cycle tale of negative productivity shocks. We heard those stories 30 years ago but the US economy finally did fully recover. Let’s hope the same occurs for the UK economy. But let’s suppose for a moment that the productivity pessimists are correct. Then Cameron’s government should cease gloating how well the UK economy is doing as a permanent fall in real income per capita is not good news.

Saturday, April 25, 2015

Good To Know Eurozone Negotiations Focusing On The Really Important Stuff

Reports out of Riga about the negotiations between Greece and other Eurozone members have been rather curious. There has been much emphasis on how the other fin ministers do not like or get along with Yanis Varoufakis, the Greek one. He did not go to dinner with them. He is the only one not wearing a tie. Draghi does not look him in the eye. Djesselbloem calls him by his first name in person and refers to him as "the Greek finance minister" when not in person. The others do not like him "lecturing" them with his British education and his time in Australia, and, gosh darn it, why does he not just up and accept their demands for full austerity for Greece!

It looks like this is more about him breaking the rules of a fraternity than about seriously coming to an agreement that most observers think is not that far away. Time for these clowns to grow up.

Barkley Rosser

It looks like this is more about him breaking the rules of a fraternity than about seriously coming to an agreement that most observers think is not that far away. Time for these clowns to grow up.

Barkley Rosser

WSJ on Scott Walker's Lumpy Labor Economiics

"Economists call this the lump of labor fallacy, which holds that the amount of available work is fixed. If one person gets a job, another loses it. But the addition of new workers into a market, especially skilled workers, can increase the productivity of companies in a way that expands the supply of work for everybody." -- Wall Street JournalExcept, of course, when economists "call this the lump of labor fallacy," they do not do so as economists. They are performing as hack propagandists. When "more doctors smoke Camels than any other cigarette," they are not offering a medical opinion.

Tuesday, April 21, 2015

Muzzling Dissent

"People everywhere confuse what they read in newspapers with news." -- A. J. "Joe" LieblingTwo somber thoughts. First, economics is not only not a science; it is not even a scholarly discipline. It is a subsection of journalism. There is the style section, the sports section, the front pages and economics. The academic jargon mills with their fancy maths are there solely to lend a cachet of prestige to the front line hacks. Case in point: Henry Hazlitt.

Second, the function of a "free press" in an oligarchy is the muzzling of dissent. As Liebling also wrote, "freedom of the press is guaranteed only to those who own one." The most effective way to muzzle dissent is to simply drown it out. That way you get to suppress speech in the name of free speech. Who could object to free speech? Those totalitarians! It's no coincidence that American fascists in the 1930s called themselves "Liberty Lobby."

Connecting the dots (and with one eye on the unexpurgated history of economic thought) the real purpose of economics today is not to foster understanding of how the economy works but to confound and marginalize those who understand even a bit of how it works.

All the flap about the "crisis of economics" and its inability to predict the great recession is so much bunk. Economics is performing exactly as it is supposed to, thank you very much.

Postscript: Having mentioned both Henry Hazlitt and Joe Liebling in one post, I started wondering if they ever crossed paths. Google Scholar produces one item that mentions both of them, a 2006 article in the Canadian Journal of Communications, "'Labor's Monkey Wrench': Newsweekly Coverage of the 1962-63 New York Newspaper Strike."

Monday, April 20, 2015

Viral Gyro Spiral

"We need campaign finance reform. We do not need 'heroes' who take meaningless flights of fancy." -- Marsha Mercer, Richmond Times-DispatchHave you ever wondered what politicians do with all that campaign finance money? They don't keep it (or at least not most of it). They spend it. On campaigning. A lot of it on advertising. Which means buying time and space in the media. Including the Richmond Times-Dispatch.

That media is not going to bite the hand that feeds it, is it? So, it's a bit rich when a columnist scolds a citizen for taking a "meaningless flight of fancy." What would Marsha Mercer do?

Labelling Doug Hughes's gyrocopter flight "meaningless" is what Mercer did. So we don't really need to ask what she "would" do. The job of the media is to spin and frame dissent as either trivial or terroristic. In an oligarchy, all dissent is either trivial or it is terror. Thus, by definition, no dissent can be "meaningful" in the sense of being both effectual and legitimate.

This is precisely the eye of the needle that Hughes threaded with his marvelous stunt. Superficially, it is about oligarchy and corruption of democracy by big money. But more profoundly -- and metaphorically -- it is about the hermetically-sealed "closed air space" over Washington. D.C. In his letter to all 535 members of Congress, Hughes quoted John Kerry on the corrosion of money in politics and it's contribution to "the justifiable anger of the American people. They know it. They know we know it. And yet nothing happens."

Kerry went on to point out how the corruption of money in politics "muzzles more Americans than it empowers." How does it do this? Well, for one, those same media outlets that profit from the spending of that corrupting money to buy advertising space also get to pass judgment on the wisdom or folly of dissenting speech: "Sit down, sit down, sit down, sit down! Sit down, you're rocking the boat!"

We need a lot more than campaign finance reform. We do not need minders and muzzlers from the media to tell us what is "meaningful" and what is not.

Saturday, April 18, 2015

Are There Any True Laws, Especially Economic Ones?

This is triggered by the recent post by Tyler Cowen and some followups by others. In it Tyler posits three laws: 1) There is something wrong with everything (no slam dunks, and one only understands something if one knows its flaws), 2) There is a literature on everything, and 3) All propositions about real interest rates are wrong. The first clearly contradicts itself, and while most laws may be limited or not universally true, some are truer than others, e.g., round earth model closer to reality than flat earth one. The second is clearly false as some ideas have never even been verbally expressed by anybody, although the real point of this is probably to warn that if somebody thinks they know the full literature on something that has a literature, they probably do not. The final one is probably empirically correct, although properly stated theoretical models contingent on unrealistic assumptions may be correct if their unrealistic assumptions hold. More generally, Tyler warns that we should all be wary of thinking we know too much, which is clearly correct.

In a followup he links to Arnold Kling who poses three laws due to his poli sci prof dad, Merle Kling: 1) Sometimes it's this way, and sometimes it's that way (I can think of some things that are pretty much always one way), 2) The data are insufficient (often the case, but maybe not always), and 3) The methodology is flawed (see 2). He calls these "iron laws of social science," but they do not look any more ironclad than Ricardo's Iron Law of Wages, which depends on some assumptions holding that are in fact not true, such as there being no technological change. More like silly putty laws.

OK, so are there really any fully true laws? Even beyond economics, most "laws" depend on certain assumptions holding for them to hold as well. In some areas, this is not such a big deal, and thus in chemistry, a lot of its laws hold pretty widely. Physics gets a bit iffier, with the good old law of gravity the classic example. Sure enough the equation explains rates of acceleration in a vacuum, but outside of a vacuum, well we even see some things moving away from each other, such as a helium balloon rising away from the earth. Nevertheless, in many hard sciences it is a lot easier to figure out when the necessary assumptions are holding and when they are not so that one can figure out when the supposed laws will apply to the real world or not, even if those assumptions do not always hold everywhere and at all times (and some physics laws hold simply everywhere at all times, as best we know).

When we get to economics, it looks to me that Tyler's first law holds pretty well. Most economics laws do not hold universally. Demand curves do not always slope downwards, even though Misesian a prioristic praxeologists insist so, and socially necessary labor time does not always determine values that equal "natural" long-run prices, even though fundamentalist Marxians might believe so. The basis "law" of supply and demand, although useful for understanding many real world markets, does not always hold in its standard formulation for a long list of reasons. And most of the laws used to study or explicate macroeconomics, such as claims about real interest rates, are by and large wrong or only true in limited cases.

Given all that, I shall note one economics law that I so far do not know of any exceptions to. That is the law of diminishing returns, or diminishing marginal productivity. Keep in mind that its formulation says that "eventually" marginal product of an input will decline, not that it is always declining, and for many agricultural activities many inputs have increasing marginal productivity for awhile. If anybody can think of a real world exception to this law, I would warmly welcome learning of it, but so far, it seems to hold universally.

Barkley Rosser

In a followup he links to Arnold Kling who poses three laws due to his poli sci prof dad, Merle Kling: 1) Sometimes it's this way, and sometimes it's that way (I can think of some things that are pretty much always one way), 2) The data are insufficient (often the case, but maybe not always), and 3) The methodology is flawed (see 2). He calls these "iron laws of social science," but they do not look any more ironclad than Ricardo's Iron Law of Wages, which depends on some assumptions holding that are in fact not true, such as there being no technological change. More like silly putty laws.

OK, so are there really any fully true laws? Even beyond economics, most "laws" depend on certain assumptions holding for them to hold as well. In some areas, this is not such a big deal, and thus in chemistry, a lot of its laws hold pretty widely. Physics gets a bit iffier, with the good old law of gravity the classic example. Sure enough the equation explains rates of acceleration in a vacuum, but outside of a vacuum, well we even see some things moving away from each other, such as a helium balloon rising away from the earth. Nevertheless, in many hard sciences it is a lot easier to figure out when the necessary assumptions are holding and when they are not so that one can figure out when the supposed laws will apply to the real world or not, even if those assumptions do not always hold everywhere and at all times (and some physics laws hold simply everywhere at all times, as best we know).

When we get to economics, it looks to me that Tyler's first law holds pretty well. Most economics laws do not hold universally. Demand curves do not always slope downwards, even though Misesian a prioristic praxeologists insist so, and socially necessary labor time does not always determine values that equal "natural" long-run prices, even though fundamentalist Marxians might believe so. The basis "law" of supply and demand, although useful for understanding many real world markets, does not always hold in its standard formulation for a long list of reasons. And most of the laws used to study or explicate macroeconomics, such as claims about real interest rates, are by and large wrong or only true in limited cases.

Given all that, I shall note one economics law that I so far do not know of any exceptions to. That is the law of diminishing returns, or diminishing marginal productivity. Keep in mind that its formulation says that "eventually" marginal product of an input will decline, not that it is always declining, and for many agricultural activities many inputs have increasing marginal productivity for awhile. If anybody can think of a real world exception to this law, I would warmly welcome learning of it, but so far, it seems to hold universally.

Barkley Rosser

Wednesday, April 15, 2015

Hughes on First?

Have to admit, the spectre of mailman flying a gyrocopter onto the lawn of the Capitol building appeals to the Sandwichman's weakness for eccentric idealists.

From the Tampa Bay Times, here is the letter that Doug Hughes was delivering to 535 members of both houses of Congress.Dear ___________,

Consider the following statement by John Kerry in his farewell speech to the Senate —

"The unending chase for money I believe threatens to steal our democracy itself. They know it. They know we know it. And yet, Nothing Happens!" — John Kerry, 2-13

In a July 2012 Gallup poll, 87% tagged corruption in the federal government as extremely important or very important, placing this issue just barely behind job creation. According to Gallup, public faith in Congress is at a 41-year record low, 7%. (June 2014) Kerry is correct. The popular perception outside the DC beltway is that the federal government is corrupt and the US Congress is the major problem. As a voter, I'm a member of the only political body with authority over Congress. I'm demanding reform and declaring a voter's rebellion in a manner consistent with Jefferson's description of rights in the Declaration of Independence. As a member of Congress, you have three options.

- You may pretend corruption does not exist.

- You may pretend to oppose corruption while you sabotage reform.

- You may actively participate in real reform.

If you're considering option 1, you may wonder if voters really know what the 'chase for money' is. Your dismal and declining popularity documented by Gallup suggests we know, but allow a few examples, by no means a complete list. That these practices are legal does not make them right! Obviously, it is Congress who writes the laws that make corruption legal.

1. Dozens of major and very profitable corporations pay nothing in taxes. Voters know how this is done. Corporations pay millions to lobbyists for special legislation. Many companies on the list of freeloaders are household names — GE, Boeing, Exxon Mobil, Verizon, Citigroup, Dow …

2. Almost half of the retiring members of Congress from 1998 to 2004 got jobs as lobbyists earning on average fourteen times their Congressional salary. (50% of the Senate, 42% of the House)

3. The new democratic freshmen to the US House in 2012 were 'advised' by the party to schedule 4 hours per day on the phones fund raising at party headquarters (because fund raising is illegal from gov't offices.) It is the donors with deep pockets who get the calls, but seldom do the priorities of the rich donor help the average citizen.

4. The relevant (rich) donors who command the attention of Congress are only .05% of the public (5 people in a thousand) but these aristocrats of both parties are who Congress really works for. As a member of the US Congress, you should work only for The People.

1. Not yourself.

2. Not your political party.

3. Not the richest donors to your campaign.

4. Not the lobbyist company who will hire you after your leave Congress.

There are several credible groups working to reform Congress. Their evaluations of the problem are remarkably in agreement though the leadership (and membership) may lean conservative or liberal. They see the corrupting effect of money — how the current rules empower special interests through lobbyists and PACs — robbing the average American of any representation on any issue where the connected have a stake. This is not democracy even if the ritual of elections is maintained.

The various mechanisms which funnel money to candidates and congress-persons are complex. It happens before they are elected, while they are in office and after they leave Congress. Fortunately, a solution to corruption is not complicated. All the proposals are built around either reform legislation or a Constitutional Amendment. Actually, we need both — a constitutional amendment and legislation.

There will be discussion about the structure and details of reform. As I see it, campaign finance reform is the cornerstone of building an honest Congress. Erect a wall of separation between our elected officials and big money. This you must do — or your replacement will do. A corporation is not 'people' and no individual should be allowed to spend hundreds of millions to 'influence' an election. That much money is a megaphone which drowns out the voices of 'We the People.' Next, a retired member of Congress has a lifelong obligation to avoid the appearance of impropriety. That almost half the retired members of Congress work as lobbyists and make millions of dollars per year smells like bribery, however legal. It must end. Pass real campaign finance reform and prohibit even the appearance of payola after retirement and you will be part of a Congress I can respect.

The states have the power to pass a Constitutional Amendment without Congress — and we will. You in Congress will likely embrace the change just to survive, because liberals and conservatives won't settle for less than democracy. The leadership and organization to coordinate a voters revolution exist now! New groups will add their voices because the vast majority of Americans believe in the real democracy we once had, which Congress over time has eroded to the corrupt, dysfunctional plutocracy we have.

The question is where YOU individually stand. You have three options and you must choose.

Sincerely,

Douglas M. Hughes

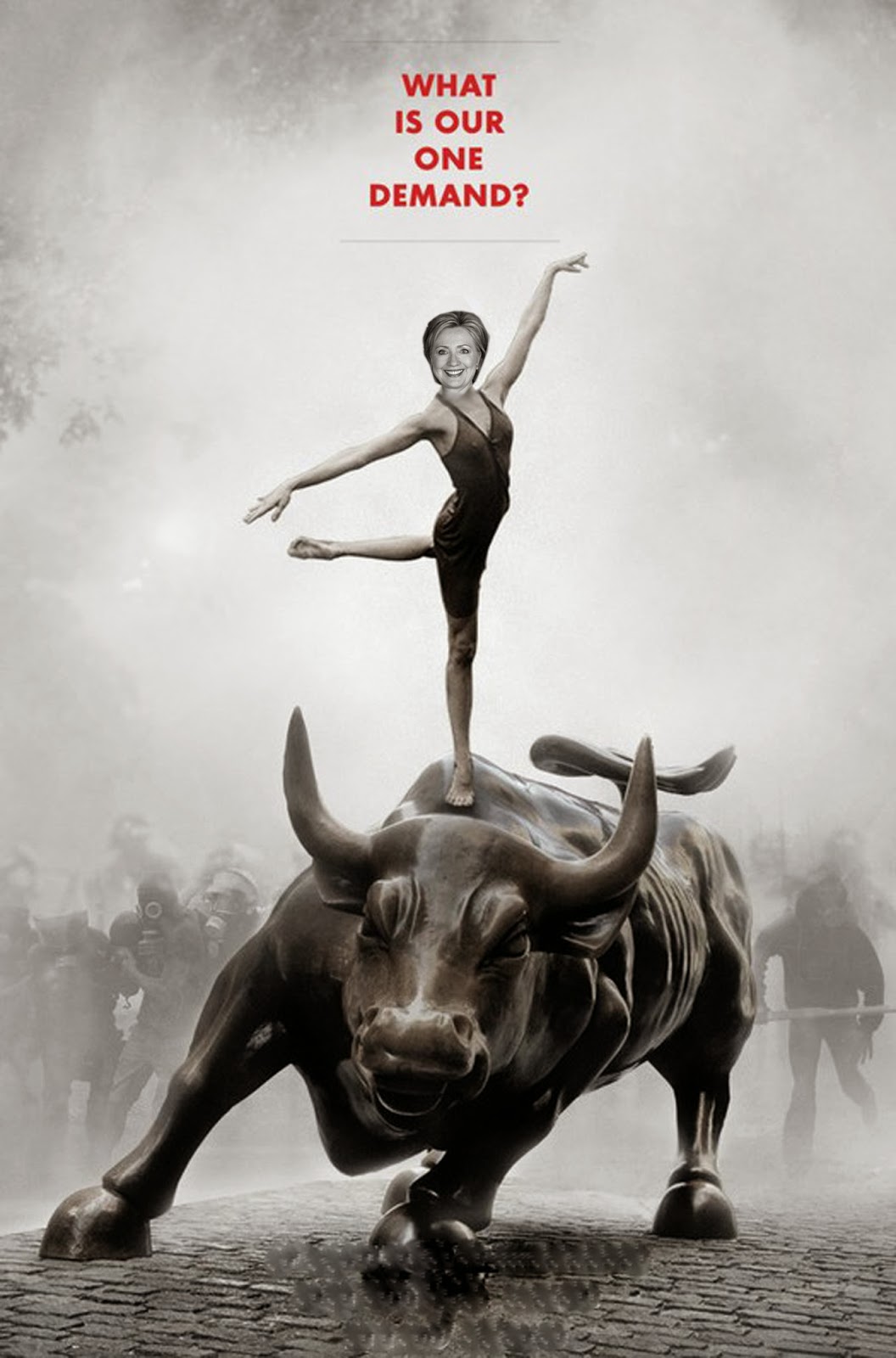

See also: WHAT IS OUR ONE DEMAND?

See also: Martin Gilens and Benjamin I. Page, "Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens"

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

Tuesday, April 14, 2015

WHAT IS OUR ONE DEMAND?

Anybody remember what that one OWS demand was? Well... "The most exciting candidate that we've heard so far is one that gets at the core of why the American political establishment is currently unworthy of being called a democracy..."

"...we demand that Barack Obama ordain a Presidential Commission tasked with ending the influence money has over our representatives in Washington. It's time for DEMOCRACY NOT CORPORATOCRACY, we're doomed without it."As Hillary Clinton said the other day in Iowa, "We need to fix our dysfunctional political system and get unaccountable money out of it once and for all even if that takes a constitutional amendment." (The Guardian observed that "It was a bold stance from Clinton, who has long courted the support of Wall Street hedge funds and is widely expected to benefit from the most expensively financed campaign in US presidential history." I suspect by "bold" they meant "brazen.")

So does that mean Hillary Clinton wants to bring "DEMOCRACY NOT CORPORATCRACY" to the U.S.A.? Uhm. Not so fast. A constitutional amendment is not a slam dunk. Some say it is delusional. What Hillary really has on offer is "hope" (with a capital

The Scam

A "soap" salesman offers to give away money wrapped in with the soap packages ( $1 to $100 bill) in order to induce the sales of his wondrous product. Using slight-of-hand the money is extracted so that none of the bars have any money. They are sold for $1 at the start. Shills will use palmed $5 and $10 bills to get sales rolling at which time the soap sales man begins to auction off the remaining packages to the highest bidder.

#OCCUPYPIKETTYHILLARY

Hillary's campaign logo has come in for quite a bit of criticism.

The logo's designer, Michael Bierut, is a graphic design superstar. Maybe he knows what he is doing? Here's what he wrote a few years back on the Occupy Wall Street "communications arsenal":

Consider, on the other hand, the genius of that simple #occupywallstreet hashtag. Three little words, with a call to action built right in. And, also right there was the potential for an articulated brand architecture that any corporate identity expert could envy. "Occupy" sits in the master brand position. Fill in the blanks for a potentially infinite number of user-generated subbrands, from Occupy Amarillo to Occupy Zurich. Elsewhere in the OWS communications arsenal, we find other slogans ("We Are The 99%") and some visual tropes (the Guy Fawkes mask popularized by Anonymous, now an emerging public "face" for the protest). But no typeface guidelines, no color standards, no official logos.Could it be, as Bierut writes in his final paragraph that "Sometimes, the key to political change isn't designing a logo or poster"? He makes the same point several times in his post: "I suspect that many of its supporters would insist that the last thing OWS needs is something as simple and reductive as a logo." "conventional graphic design seems like an inefficient way to make a point, never mind to create or fuel a political movement"

I suspect there may be a method to the Hillary logo's banality. It is extremely simple to repurpose. Initially, even the Sandwichman had a few yucks:

The Incredibly Bad Timing of John Wilkes Booth

When John Wilkes Booth assassinated President Abraham Lincoln 150 years ago today on April 14, 1865, it happened to be a Good Friday. I do not know if he and his associates thought about how this would be viewed by the American people of that time, including even most southerners, much less the longer run view of history, but the timing instantly turned a man who had been quite unpopular in many quarters even in the North into a martyred and sanctified Christlike figures. Perhaps Booth thought people would view him that way, but he was mistaken.

Barkley Rosser

Barkley Rosser

Monday, April 13, 2015

GE Capital and Repatriation Taxes

Peter Eavis writes:

More than 10 years ago, the kinds of investors who seek out weak companies were circulating presentations on Wall Street that argued that General Electric’s enormous lending business was a ticking time bomb. The financial crisis of 2008 proved those skeptics right, and on Friday, they appeared to have the final laugh. General Electric announced that it was selling most of the loans inside its financial division, GE Capital, leaving a G.E. that will be dominated by industrial businesses. The shift, to be completed by 2018, would end one of the riskiest experiments in finance. It also indicates that regulations intended to limit destabilizing financial practices are starting to bite.That Dodd-Frank reforms take away the joys of regulatory arbitrage just bites. And I guess paying U.S. taxes also bites as noted by Steve Goldstein:

General Electric’s deal to sell off real estate and get out of most of the finance business contains a little sweetener for the U.S. government, in the form of up to $4 billion worth of taxes on repatriated earnings. The issue of tax repatriation is arguably the hottest one in corporate tax policy. Right now, U.S.-based multinationals are not taxed by the U.S. government on what they earn overseas — until they bring that money back to the U.S.GE is saying that this repatriation tax might be as much as $7 billion. But the GE Capital alone segment was parking $36 billion overseas. They have paid a modest amount of foreign taxes so they get a Foreign Tax Credit. And its other divisions are still parking a lot of profits overseas, which will likely not be repatriated allowing the effective tax rate for these other segments of their business to remain below 20%. Steve continues:

According to a report in March by Credit Suisse’s David Zion, the cumulative earnings parked by S&P 500 companies overseas is over $2 trillionUnder current law, the repatriation tax would be 35% minus any Foreign Tax Credits. Let’s assume that foreign taxes are 20% of foreign earnings. This would mean the US Treasury could net 15% of this $2 trillion if deferral benefits were ended. And $300 billion could finance a lot of infrastructure investment. But Steve notes that Washington is proposing to change this tax:

President Barack Obama has proposed a one-tax 14% tax on $2 trillion of overseas earnings, followed by a 19% minimum tax on future profit, and former House Ways and Means Committee Chairman Dave Camp proposed a one-time tax of 8.75%.For companies whose foreign earnings are in tax havens, these proposals would raise at least some tax revenues but for companies where the foreign tax rate is above 19%, even the Obama proposal would effectively eliminate the repatriation tax given the Foreign Tax Credit.

Subscribe to:

Comments (Atom)